Planned, Non-Cash & Estate Gifts

Whether you are planning for retirement, looking to provide for a loved one, or seeking to maximize your gift, there are many methods of giving that can benefit you while supporting Yale’s historic For Humanity campaign. Learn more about the many ways to create your legacy, including options that offer you significant financial and tax advantages.

Gift Options

From bequests to donor advised funds, learn about the wide range of options for giving to Yale while meeting your financial and philanthropic goals.

Gift Planning Tools & Resources

Planned gifts offer a variety of ways to support Yale with additional benefits to you. You and your financial advisor can use these tools and resources to get started.

Yale Legacy Partners

The Yale Legacy Partners is a society of alumni, family, and friends who have made a bequest or planned gift to the university. By becoming a Yale Legacy Partner, you join a group of others who have provided for generations of students and scholars to come.

Highlights: Partners through Giving

April 1, 2020

For Future Generations

Caroline Hsaio Van ’79 supports Yale financial aid with a charitable gift annuity.

September 1, 2020

A Scholarship for Veterans at Yale

Barbara Guss ’74 created a Yale charitable gift annuity to honor family and service.

September 1, 2020

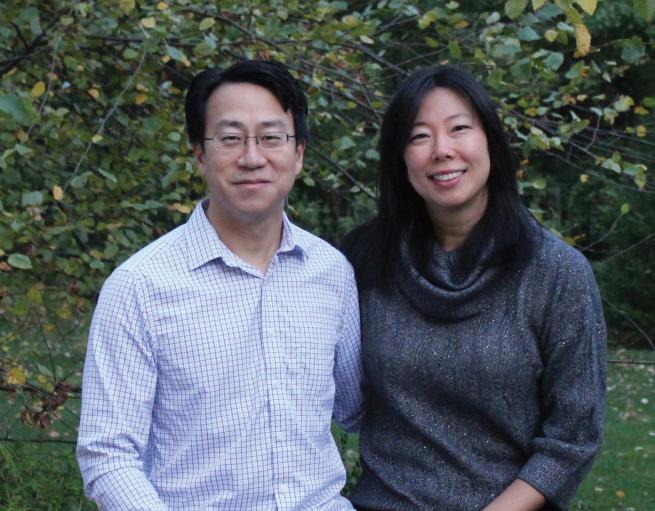

Training the Next Generation of Doctors

Eon Shin ’01 MD and Nara Shin ’02 MD met at Yale School of Medicine, which shaped their lives and careers. Now they’re giving back.